In this comprehensive guide, we delve into the top 10 best insurance companies in Pakistan, offering an honest and insightful review based on extensive research and also direct interactions with customers. Our aim is to provide you with a transparent overview of each company, allowing you to make informed decisions about your financial security.

These companies provide a diverse array of insurance products, covering aspects such as life, health, property, and automobile insurance, among various others. Their role is pivotal in securing people and their businesses from unforeseen events, like accidents, illnesses, and sadly, even death. I suggest considering insurance as a shield that protects you and your loved ones from these unpredictable events.

Jubilee Life Insurance

CEO: Current Managing Director and CEO: Mr. Javed Ahmed

Background: Jubilee Life Insurance Company Limited, incorporated on June 29, 1995, operates as a public limited company under the Companies Act, 2017. As a subsidiary of Aga Khan Fund For Economic Development, S.A, Switzerland, it specializes in non-participating life insurance.

Authority Check: Jubilee Life Insurance is registered with the Securities and Exchange Commission of Pakistan (SECP), providing clients with the assurance of regulatory compliance.

Regulatory Authority: Securities and Exchange Commission of Pakistan (SECP)

Online Presence :

An online presence is a window into the transparency and accessibility of an insurance company. Jubilee Life Insurance maintains an official website, www.jubileelife.com, offering clients a user-friendly platform to explore products, get information, and even access financial overviews through DPS PSX

Jubilee Life Insurance has a significant social media presence, with 1.1 million followers on Facebook, 46,000 followers on LinkedIn (with 1K-5K employees), and 10.3K followers on Instagram.

Testimonials:

The 90 reviews on Google My Business (GMB) with a 3.3 rating provide a mixed perspective. While some clients express dissatisfaction, others praise the company for its services, specifically mentioning dedicated employees like Mr. Ahmed Zia and Mehak.

Jubilee Life Insurance Plans

Individual Life Insurance

- Mission: Provide end-of-life security and enable clients to live life to the fullest.

- Plans for child education and dream weddings.

- Solutions for financial shocks of inflation.

- Retirement life assurance.

Bancassurance

- Concept: One-stop shop for banking, insurance, and financial needs.

- Pioneered Bancassurance in 2003.

- Expanding network through innovative products and high customer service levels.

Micro Insurance

- Focus: Providing insurance benefits to over 1,000,000 people in poverty.

- Principles: Affordability, Accessibility, Flexibility, and Simplicity.

- Products: Credit Life, Savings Completion, and Funeral Expense.

Corporate Insurance

- Legal requirement for employers.

- Premium deductible from taxable income.

- Corporate rates more affordable and flexible than individual plans.

Online Insurance

- Quick and affordable financial security for the family.

- Plans available online for easy access and quick approval.

Overview of All Plans

- Engages in non-participating life insurance business.

- Operates in segments like Individual Life Unit Linked, Conventional Business, Accident & Health, Overseas Group Life & Health, Individual Family Takaful, Group Family Takaful, and Accident & Health Family Takaful.

- Headquarters: Karachi, Pakistan.

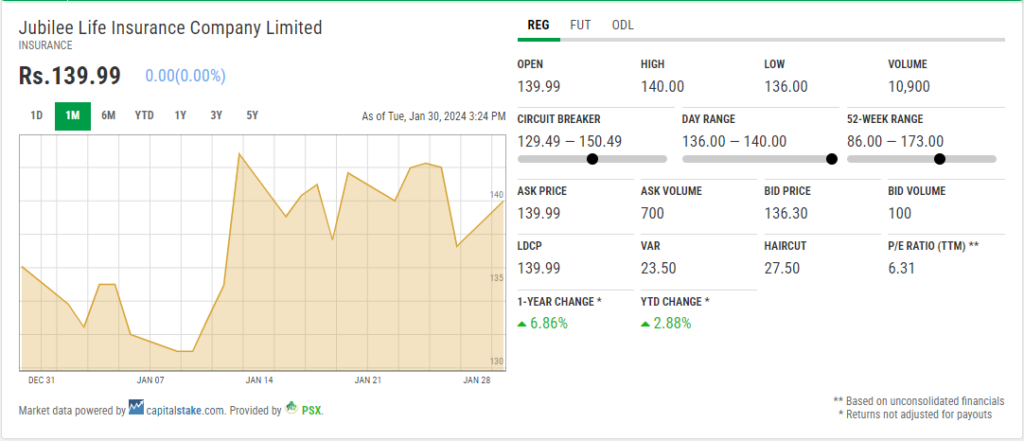

Stock Quote for Jubilee Life Insurance Company Limited

2. EFU Life Insurance

Parent Organizations: Eastern Federal Union Insurance Company Limited, Jahangir Siddiqui & Co.

CEO: Taher G. Sachak (since 1994)

Headquarters: Karachi

Founded: 1932

Background: Incorporated on August 9, 1992, EFU Life Assurance Limited commenced operations on November 18, 1992. Engaged in various life insurance businesses, including ordinary life, pension fund, and accident and health, EFU Life is a subsidiary of EFU General Insurance Ltd.

Online Presence: A reputable insurance company’s online presence is crucial for providing clients with accessibility and transparency. EFU Life Assurance Limited maintains an official website https://www.efulife.com/, offering a user-friendly platform for clients to explore products and access relevant information.

Social Authority

- Facebook Followers: 2.1M

- LinkedIn Followers: 46K (5K-10K employees)

- Instagram Followers: 13.6K

Testimonials: Client testimonials provide insights into the customer experience and satisfaction levels. EFU Life Assurance Limited has garnered positive reviews on Google My Business (GMB), with a notable 4.5 rating. Clients commend the company for its reliability, cooperative staff, and its role in securing their future.

EFU Life Insurance Plans

EFU Life Assurance Limited offers a diverse range of insurance plans catering to different needs. Let’s explore some of the key offerings:

Emerald Plan

- High allocation in initial years for significant fund value at maturity.

- Options tailored to policyholder needs.

- Inflation protection benefit.

- Fund Acceleration Premium for additional savings.

- Partial or full withdrawal options.

Group Savings Plan

- Minimum basic premium as low as PKR 7,200 per annum.

- Participation in high returns of EFU Income Growth Fund.

- Loyalty bonus from the 6th year onward.

- Hedge against inflation through Inflation Protection Benefit.

Humsafar Plan

- Competitive unit allocation structure.

- Additional bonus unit allocation from the 6th year onward.

- Additional riders for enhanced insurance protection.

- Fund Acceleration Premium for extra savings.

- Partial or full withdrawal options.

Nisa Savings Plus Plan

- Built-In LifeCare Female Benefit.

- Additional riders for enhanced insurance protection.

- Fund Acceleration Premium for extra savings.

- Inflation protection benefit.

- Partial or full withdrawal options.

Savings Plan

- Participation in high returns of EFU Income Growth Fund.

- Minimum basic premium as low as PKR 12,000 per annum.

- Inflation Protection Benefit.

- Accidental death benefit rider.

- Lifecare Enhanced Benefit covering 20 critical illnesses.

Security Plus Plan

- Non-unit linked plan for family monetary protection.

- Three variants for different income levels.

- Additional riders for extra sum assured.

- Joint life cases option.

Prosperity For Life

- Whole-of-life insurance protection.

- Two exclusive options for insurance and investments.

- Loyalty bonuses.

- Fund Acceleration Payments for fund buildup.

- Participation in returns of EFU Growth Funds.

Education Plan

- Built-in Continuation Benefit for a child’s future education.

- Optional Income Benefit for educational expenses in case of death.

- Flexible plan duration.

- Inflation Protection Benefit.

- Tailored supplementary benefits.

Stock Quote for EFU Life Assurance Limited

3. Adamjee Insurance

Leadership: Sir Adamjee Haji Dawood

Adamjee Insurance, a part of the esteemed Adamjee Group of Companies based in Karachi, Pakistan, has established itself as a key player in the insurance industry. This comprehensive guide offers a detailed overview of the company, including its background, online presence, customer testimonials, and a thorough exploration of its insurance plans.

Background and Ownership

Adamjee Group of Companies, historically led by Sir Adamjee Haji Dawood, is a conglomerate known for its prominence in Karachi. As of 2007, the group’s owners were unofficially estimated to be among the top 40 wealthiest families in Pakistan, showcasing the company’s financial strength and stability.

Online Presence

In today’s digital age, an online presence is indicative of a company’s accessibility and engagement. Adamjee Insurance maintains a significant online footprint:

- LinkedIn Followers: 27K (501-1K employees)

- Facebook Followers: 7.7K

- Instagram Followers: 1,131

Customer Testimonials

Customer testimonials are a vital aspect of evaluating an insurance company. Adamjee Insurance has received 284 reviews on Google My Business (GMB) with an overall rating of 3.9. Customers express positive sentiments about the company’s service, cooperative teams, and the overall environment. However, as with any company, there are mixed reviews, including instances of dissatisfaction related to claims.

Positive Testimonials

- “Head Office for Adamjee Insurance, Good place. Parking inside the office is limited. You need to park outside.”

- “One of the best insurance providers in the industry, Best place to work.”

- “Very cooperative & supporting team of AICL.”

- “Top rating and Pakistan’s biggest Insurance company.”

Insurance Plans

Adamjee Insurance offers a diverse range of insurance plans, catering to various needs:

Car Insurance

- Comprehensive coverage protecting against accidents, theft, or natural disasters.

- Options for third-party, comprehensive, and own damage policies.

- Affordable premiums for different coverage levels.

Travel Insurance (GoSecure)

- Designed to fulfill traveling needs, providing 24/7 coverage against travel inconveniences.

- Partnered with International SOS for medical assistance and a wide range of services.

- Direct settlement of medical claims in Schengen States.

Health Insurance

- Financial protection for medical and healthcare costs.

- Coverage for hospital stays, prescription drugs, and other healthcare services.

- Alleviates the financial stress of unexpected medical expenses.

Personal Accident Insurance

- Financial security in the event of unintentional harm, disfigurement, or death.

- Aids in coping with the financial effects of accidents.

- Provides peace of mind against unforeseen circumstances.

Home Insurance

- Financial security for your house and its belongings.

- Protection against unexpected events or possible property damage.

- Aids in recovery and rebuilding after unforeseen incidents.

Stock Quote for Adamjee Insurance Company Limited

For more detailed information, you can visit Adamjee Insurance Company Limited.

4. Alfalah Insurance

Background and Management Team

Established in 2006, Alfalah Insurance Company Limited has rapidly expanded its operations, with offices in major cities across Pakistan. The company is headquartered in Lahore, Punjab, and is led by a seasoned management team:

- Abdul Haye (CEO)

- Adnan Waheed (Executive Director Finance & CFO)

- Raza Javaid (General Manager – Commercial)

- Faisal Shahzad (General Manager – Internal Audit)

Online Presence

A company’s online presence is crucial for communication and engagement. Alfalah Insurance Company Limited has a notable digital footprint:

- LinkedIn Followers: 5K (51-200 employees)

- Facebook Followers: 888K

- Instagram Followers: 82.5K

Customer Testimonials

Customer testimonials offer insights into the real experiences of clients with the company. Alfalah Insurance has garnered positive reviews on Google, with 101 reviews and an overall rating of 4.2. Customers praise the company for its professionalism, cooperation, and quality of service.

Positive Testimonials

- “Outstanding experience. Highly professional and cooperative response. Will definitely recommend others.”

- “Good insurance company under the Alfalah Group.”

- “The motor insurance of this company is good and competitive. Staff is also professional.”

Alfalah Insurance Plans

Alfalah Insurance Company Limited offers a range of insurance plans catering to diverse needs:

Health Insurance

- Comprehensive coverage for medical expenses.

- Inclusive of daily room charges, operation theatre charges, diagnostic tests, and more.

- Pre-admission and post-hospitalization benefits.

Motor Insurance

- Comprehensive policy for private cars, commercial vehicles, and motorcycles.

- Covers loss or damage due to accidents, fire, burglary, malicious acts, and natural disasters.

- Liability coverage for third-party bodily injury or property damage.

Property Insurance

- Various forms of property insurance for comprehensive coverage.

- Covers fire and allied perils, property all risks, comprehensive machinery, business interruption, and more.

- Tailored covers to safeguard assets against fortuitous losses.

Marine Cargo Insurance

- Standard coverage under Institute of London Underwriters clauses (Clause A, B, or C).

- Comprehensive “ALL RISK” cover under Clause A.

- Coverage for named perils under Clause B and C.

Energy Insurance

- Covers a wide range of energy risks, including oil & gas, petrochemicals, and electric utilities.

- Protection against material damage, business interruption, contingent business interruption, and downstream liabilities.

Engineering Insurance

- Contractor’s All Risk Policy (CAR) for construction projects.

- Covers loss or damage to contract works, third-party claims, and contractor’s plant and equipment.

Miscellaneous Insurance

- Personal Accident Insurance: Cover against accidental death and disability.

- Money Insurance: Protection against loss of money due to burglary, armed hold-up, and snatching.

- Banker’s Blanket Takaful, Fidelity Guarantee Takaful, Mobile Phone Takaful, Plate Glass Takaful, Safe Deposit Box/Locker Takaful, Neon Sign Takaful: Various forms of takaful covers.

Stock Quote for Bank Alfalah Limited

For detailed insights and up-to-date information, you can visit Bank Alfalah Limited.

5. State Life Insurance

Background and Leadership

State Life, as a significant player in the insurance sector, boasts the largest agency network in Pakistan, consisting of approximately 200,000 sales personnel. While its primary focus is on life insurance, State Life is also actively engaged in diverse business activities such as investing policyholders’ funds in government securities, the stock market, and real estate. The corporation is led by a chairman, currently Shoaib Javed Hussain, along with four directors, all appointed by the Government of Pakistan. The Principal Office of State Life is located in Karachi.

Online Presence

A company’s online presence is a vital aspect of communication and outreach. State Life Insurance Corporation maintains a robust digital presence:

- LinkedIn Followers: 3K (10K+ employees)

- Facebook Followers: 156K

- Instagram Followers: 3,802

Customer Testimonials

Understanding the customer experience is crucial. State Life has garnered positive reviews on Google, with 30 reviews and an overall rating of 4.1. Customers appreciate the company’s service, polite behavior, and positive experiences.

Positive Testimonials

- “Nice place, good service, and polite behavior, all experiences as well.”

- “Good company.”

- “This company has a good experience with insurance plans.”

State Life Insurance Plans

State Life Insurance Corporation offers a variety of insurance plans catering to different needs. Let’s explore some prominent plans along with a short summary paragraph for each:

Golden Endowment

This plan offers a unique combination of insurance and savings, providing financial security for the policyholder and attractive returns upon maturity. It is designed for those seeking long-term financial stability with the added benefit of wealth accumulation.

Whole Life Assurance

This plan ensures lifelong coverage, offering a comprehensive solution with guaranteed death benefits. It is suitable for individuals looking for a policy that provides financial protection throughout their lifetime.

Endowment Assurance

A well-rounded plan that combines insurance protection with a savings component. It provides a lump sum amount at the end of the policy term, offering both security and a financial cushion for the future.

Sadabahar Plan

Catering to a wide audience, this plan offers financial protection along with a savings element. It is designed to provide stability and financial support during critical life stages.

Anticipated Endowment Assurance

Anticipated Endowment Assurance Plan:

This plan anticipates the financial needs of policyholders at different life stages. It combines insurance coverage with periodic payouts, ensuring financial support when it matters the most.

Shad Abad Assurance

A comprehensive plan that caters to a broad spectrum of needs. Shad Abad Assurance combines life insurance coverage with savings, providing a holistic financial solution for policyholders.

Jeevan Saathi Assurance

Tailored for couples, this plan ensures financial security for both spouses. It combines life insurance benefits with savings, offering a secure future for the policyholders and their families.

Child Education & Marriage Assurance

Child Education & Marriage Assurance Plan:

This plan is designed to secure a child’s future by providing financial support for education and marriage expenses. It combines life insurance coverage with savings, ensuring a stable financial foundation for the child.

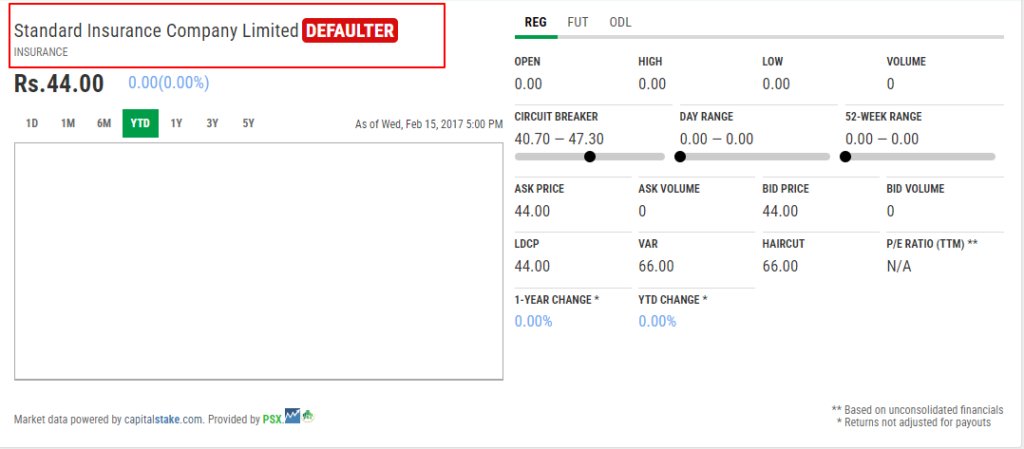

Stock Quote for Standard Insurance Company Limited Shows DEFAULTER

For a comprehensive overview and current details, you can refer to Standard Insurance Company Limited.

6. CICL (Century Insurance Company Ltd)

Established on October 10, 1985, under the Companies Act 2017, CICL has evolved into a dynamic insurance company, offering solutions for various aspects of life. This guide delves into the background, leadership, online presence, customer testimonials, and a brief analysis of CICL’s insurance plans.

Background and Leadership

CICL has been actively engaged in general insurance business since its inception. The company received authorization from the Securities and Exchange Commission of Pakistan (SECP) on August 07, 2017, to undertake Window Takaful Operations. The leadership team includes Mohammad Hussain Hirji as the CEO, Iqbal Ali Lakhani as the Chairperson, and Mansoor Ahmed serving as the Company Secretary.

Online Presence

A robust online presence is crucial for effective communication and outreach. CICL showcases a strong digital presence:

- LinkedIn Followers: 2K (51-200 employees)

- Facebook Followers: 60K

- Instagram Followers: 5,238

Customer Testimonials

Customer testimonials provide insights into the customer experience. CICL has received positive reviews on Google, with 26 reviews and an overall rating of 4.0. Customers appreciate the company’s services and offerings.

Positive Testimonials

- “I’d invested online with $700, and I earned my profit of $7,500 right now. Just a week interval of trading, I made such from Mrs. Helen Karen.”

- “One of the best insurance companies, which excels in various services.”

- “One of the best Century Insurance companies with an A+ Rating for Motor, Fire, Marine, group Health, and Different projects.”

Challenges Faced by Customers

- One consumer said to me: “It was the first time I called on their given numbers to claim my motor insurance, but their operators do not even know how to talk to customers.”

Insurance Plans

CICL offers a comprehensive suite of insurance plans, catering to diverse needs. Let’s explore some prominent plans along with a short summary paragraph for each:

Fire Insurance

CICL’s Fire Insurance provides coverage against damages caused by fire, ensuring financial protection for businesses and individuals. The plan is designed to mitigate the financial impact of fire-related incidents.

Motor Insurance

CICL’s Motor Insurance offers comprehensive coverage for vehicles, protecting against damages, theft, and third-party liabilities. The plan is tailored to provide financial security and peace of mind for vehicle owners.

Marine Insurance

CICL’s Marine Insurance caters to the unique risks associated with marine transport. The plan provides coverage for goods in transit, ensuring protection against potential losses during sea voyages.

Miscellaneous Insurance

This plan offers a versatile solution, covering a range of miscellaneous risks. CICL’s Miscellaneous Insurance provides tailored coverage for various unforeseen events, offering financial security in diverse scenarios.

Engineering Insurance

CICL’s Engineering Insurance is crafted to protect businesses from financial losses arising due to engineering-related risks. The plan covers damages to machinery and equipment, ensuring continuity of operations.

Travel Insurance

Designed for travelers, this plan provides comprehensive coverage for unforeseen events during journeys. CICL’s Travel Insurance offers peace of mind, covering medical emergencies, trip cancellations, and more.

Home Safe Insurance

CICL’s Home Safe Insurance is designed to safeguard homes and their contents. The plan provides coverage against risks such as fire, theft, and natural disasters, ensuring homeowners’ peace of mind.

Family Shield – PA Plan

This plan focuses on personal accident coverage, providing financial protection in case of accidental injuries or death. CICL’s Family Shield – PA Plan is crafted to support individuals and their families during challenging times.

Stock Quote for Century Insurance Company Limited

For detailed insights and up-to-date information, you can visit Century Insurance Company Limited

7. UBL Insurers Ltd

Background and Ownership

Founded as a collaboration between UBL and the Bestway Group, UBL Insurers Limited is registered as an insurer with the Securities and Exchange Commission of Pakistan. It has been granted the license to transact general insurance, contributing to the diverse financial services offered by UBL.

Mission Statement

The mission of UBL Insurers is to establish itself as a reputable general insurer in the country by providing dedicated service to customers. The company aims to achieve this by understanding customer needs, delivering unique products, and ensuring prompt claims servicing within optimal time frames.

Financial Performance

By the grace of Almighty, UBL Insurers has underwritten a gross premium of Rs. 3.8 billion during 2018, including window Taka operations. The company has been assigned an “AA” rating by JCR VIS, a testament to its financial strength and stability.

Branch Network

UBL Insurers Limited operates through full-fledged branches in major cities like Karachi, Lahore, Multan, Faisalabad, Islamabad, Hyderabad, and Bahawalpur. Additionally, the company has a sub-office in Peshawar, allowing it to provide comprehensive services across these regions.

Online Presence

An effective online presence is crucial for modern businesses. UBL Insurers Limited showcases its digital strength with:

- LinkedIn Followers: 4K

- Facebook Followers: 14K

Customer Testimonials

Customer testimonials provide valuable insights into the customer experience with UBL Insurers. The company has received positive reviews on Google, with 28 reviews and an overall rating of 4.0. Customers appreciate the company’s quick response and quality services.

Positive Testimonials

- “UBL Insurers is a good company for insurance purposes. And they give a quick response.”

- “This is a good company, and all services are great.”

- “Quick and fast insurance service in town.”

- “Best insurance company I have ever audited.”

UBL Insurers Ltd Plans

BetterLife Bancassurance

BetterLife Bancassurance Plan:

UBL Insurers offers BetterLife Bancassurance, a plan designed to provide a comprehensive financial safety net. This plan integrates banking and insurance, offering customers a seamless solution for their financial needs. It aims to enhance the overall well-being of customers by providing a range of benefits and coverage options.

This Bancassurance plan leverages the synergy between UBL’s banking expertise and UBL Insurers’ insurance capabilities. Customers can expect personalized and flexible coverage that aligns with their financial goals and priorities.

Stock Quote for United Bank Limited

For a comprehensive overview and the latest information, you can refer to United Bank Limited

8. Habib Insurance

Established in 1942 as one of the pioneering projects of the Habib Group, Habib Insurance Company Limited has emerged as a stalwart in the insurance sector. Initially based in Bombay, the company relocated its head office to Karachi after the Partition in 1947. With a strong emphasis on Fire, Marine, Motor, Engineering, and Miscellaneous insurance, Habib Insurance has over seven decades of experience and has become a leading insurance provider in Pakistan.

Background:

The company’s journey includes capital consolidation through bonus share issuance, establishing itself as a significant player. Having a paid-up share capital of Rs. 2.5 million in its early days, Habib Insurance has thrived, ensuring profitability and liquidity. The company boasts a robust underwriting policy and solid reinsurance arrangements with top global companies, including Hannover Re, Scor Re, Korean Re, Trust Re, Best Re, and Pakistan Reinsurance Co. Ltd.

Mission and Innovation

With a mission to provide high-quality service to customers and consistent returns to shareholders, Habib Insurance is adapting to the evolving industrial and financial landscape in Pakistan. The company actively explores new products and markets, investing in innovative ideas to meet changing market demands. This commitment to innovation has garnered recognition, with the Karachi Stock Exchange presenting Habib Insurance the outstanding performance award twelve times.

Awards and Recognitions

The Karachi Stock Exchange instituted an outstanding performance award in 1981, and Habib Insurance has claimed this honor twelve times. Notably, the company secured the award for eight consecutive years from 1979 to 1986 and later in 1993, 1995, 1997, and 2014.

Online Presence

Reflecting its commitment to modernity, Habib Insurance maintains a robust online presence, allowing stakeholders to connect and stay informed. Key online statistics include:

- LinkedIn Followers: 3K

- Facebook Followers: 3.3K

Customer Testimonials

Customer reviews highlight positive experiences and emphasize the company as a “Shield of Protection.” With a 4.0 rating on Google from six reviews, Habib Insurance enjoys a good reputation among its customers.

Habib Insurance Plans

Property Insurance

Habib Insurance’s Property Insurance offers comprehensive coverage for various property risks. From safeguarding against fire incidents to protecting assets, this plan is tailored to meet the diverse needs of property owners. The company’s decades of experience and robust underwriting policy ensure that customers receive effective protection for their valuable assets.

Marine Insurance

Habib Insurance’s Marine Insurance provides coverage for risks associated with marine activities. Whether it’s shipping, cargo transportation, or related ventures, this plan ensures that businesses and individuals are protected against unforeseen events. The company’s strong reinsurance arrangements further enhance the reliability of this insurance offering.

Motor Insurance

Tailored for vehicle owners, Habib Insurance’s Motor Insurance plan provides comprehensive coverage for cars and other vehicles. With a focus on addressing the specific risks associated with motor vehicles, this plan offers financial protection in the event of accidents, theft, or other unforeseen incidents. Customers benefit from the company’s extensive experience and commitment to service quality.

Engineering Insurance

Habib Insurance’s Engineering Insurance is designed to safeguard businesses involved in engineering projects. From construction to machinery breakdown, this plan offers coverage for a range of engineering-related risks. The company’s dedication to innovation and service excellence ensures that customers receive tailored solutions for their engineering insurance needs.

Travel Insurance

Catering to the needs of travelers, Habib Insurance’s Travel Insurance plan provides coverage for unforeseen events during domestic and international journeys. Whether it’s medical emergencies, trip cancellations, or baggage losses, this plan ensures that travelers can navigate unexpected situations with financial security. Habib Insurance’s longstanding reputation for profitability and reliability enhances the trustworthiness of this travel insurance offering.

Miscellaneous Insurance

For diverse insurance needs beyond the specific categories, Habib Insurance offers a Miscellaneous Insurance plan. This versatile offering provides coverage for a range of risks that may not fit neatly into other categories. The company’s agility and commitment to meeting market demands make this plan a flexible solution for various insurance requirements.

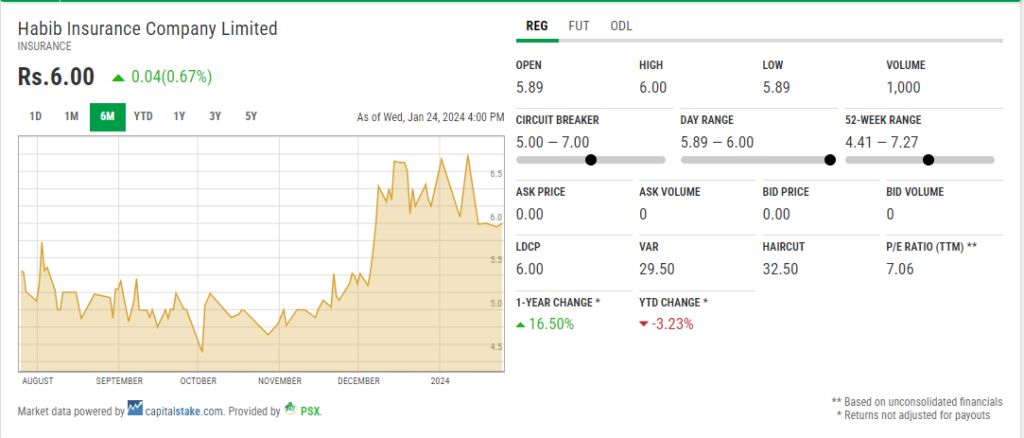

Stock Quote for Habib Insurance Company Limited

For detailed insights and the latest updates, you can visit Habib Insurance Company Limited

.

Conclusion

The article navigates through the leadership, reputation, online presence, and customer testimonials of Jubilee Life Insurance, EFU Life Assurance Limited, Adamjee Insurance, Alfalah Insurance, State Life Insurance, CICL, UBL Insurers Ltd, and provides a snapshot of their diverse insurance plans.

Furthermore, it sheds light on the rich histories, online footprints, customer sentiments, and detailed insurance plans of Adamjee Insurance, Alfalah Insurance, State Life Insurance, CICL, and UBL Insurers Ltd. The testimonials, both positive and challenging, give readers a balanced perspective on the customer experience with these companies.

It stands as a guide for those navigating the complex terrain of insurance options, providing a holistic view of the diverse offerings and helping individuals and businesses make informed choices to secure their financial futures.