Investing in Pakistan is a great way to grow your money and plan for the future. It’s important to find the right company to help you with this. In this guide, we’ll introduce you to some of the best investment companies in Pakistan for 2024. These companies are known for their good work and can help you whether you’re new to investing or have been doing it for a while. We’ll explain what makes these companies special and how they can help you make smart choices with your money. Whether you want to invest a little or a lot, our guide will show you where to start. Let’s explore these companies together and find the best way for you to invest in Pakistan’s growing economy.

1. Unilever Pakistan

CEO: Amir Paracha

Background: Established in 1948 as Lever Brothers Pakistan Limited, Unilever Pakistan is a subsidiary of the global giant Unilever. It’s a beacon in the fast-moving consumer goods (FMCG) sector in Pakistan.

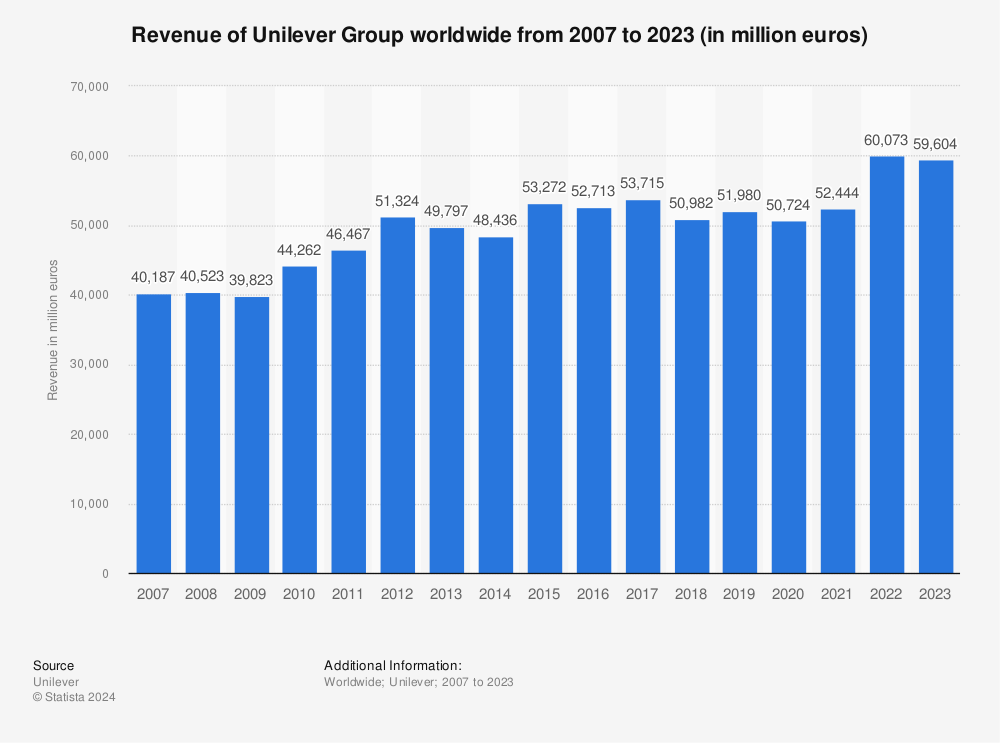

Financials: With a revenue of 28.3 billion INR in 2022 and a whopping market capitalization of $121.9 billion, Unilever represents a robust financial profile.

Investment Highlights: A solid price-earnings ratio of 13.5 and a 3.8% dividend yield make Unilever a compelling option for those seeking stable and consistent returns.

– Market Strategy and Product Range: Unilever Pakistan’s success can be attributed to its wide range of popular products, including food, beverages, cleaning agents, and personal care products. Their strategy focuses on understanding local consumer needs and adapting global best practices to the Pakistani market.

– Sustainability and Innovation: A key aspect of Unilever’s business model is its commitment to sustainability and innovation. The company invests in research and development to create products that are not only consumer-friendly but also environmentally responsible, aligning with global sustainability goals.

Revenue of Unilever Group worldwide from 2007 to 2022

2. Engro Foods

CEO: Ghias Khan

Ownership and Legacy: As a subsidiary of the Engro Corporation, Engro Foods symbolizes innovation and quality in Pakistan’s food industry.

Employee Strength: With over 2,800 employees, the company’s human capital is a testament to its operational strength.

Investor’s Edge: High employee satisfaction and a diverse product portfolio underscore Engro Foods as a promising investment destination.

– Market Penetration and Product Diversity: Engro Foods has made a significant impact in the food industry with products ranging from dairy to ice cream and fruit juices. Their emphasis on quality and affordability has helped them penetrate various market segments.

– Corporate Responsibility and Growth: The company is also known for its corporate social responsibility initiatives, focusing on health and nutrition. Engro Foods’ continuous growth can be seen in its expanding product lines and market reach.

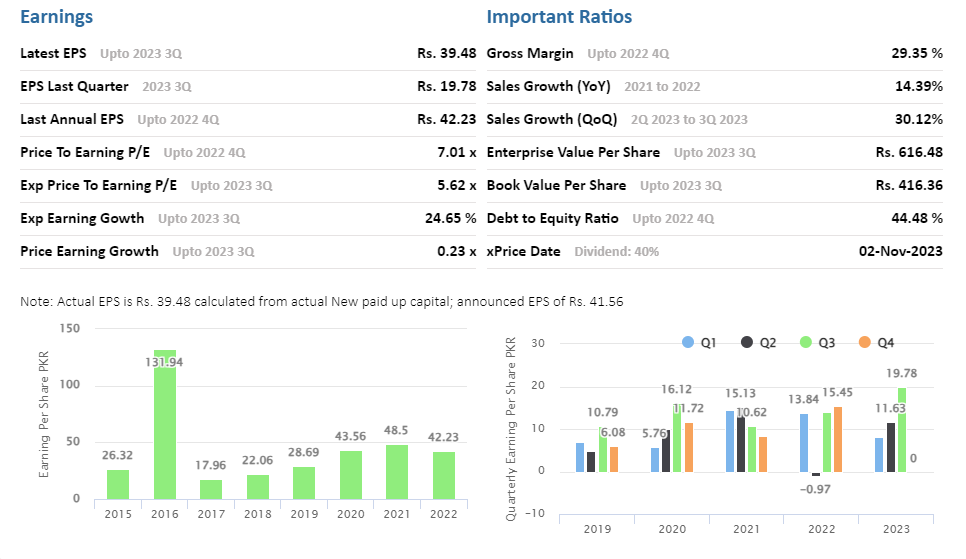

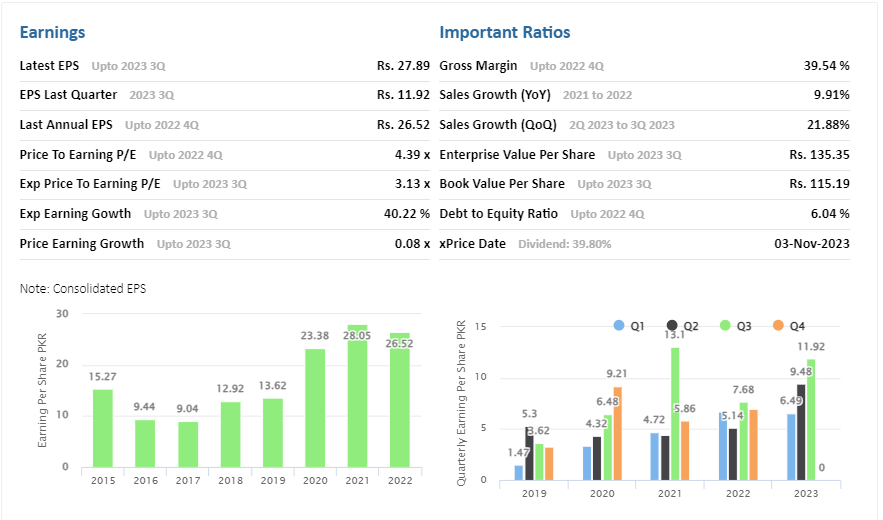

Engro Foods Stats from 2019 to 2023

Engro Foods Limited is a subsidiary of Dawood Hercules Corporation Limited. The company manages investments in subsidiary companies, associated companies, and joint ventures. These companies are engaged in various sectors such as fertilizers, PVC resin manufacturing and marketing, food, energy, development and operations of telecommunication infrastructure, LNG, chemical terminal, and storage businesses. You can find more information about Engro Foods Limited’s financial reports and performance on There

3. Hub Power Company

Leadership: Muhammad Kamran Kamal

The Powerhouse: HUBCO stands as Pakistan’s largest independent power producer, a pivotal player in the energy sector.

Achievements: A recipient of numerous awards, including the PSX Top 25 Companies Award, HUBCO’s operational excellence is well-recognized.

Why Invest: Its track record of dividend payouts and a robust balance sheet position it as a secure and lucrative investment.

– Energy Production and Expansion: HUBCO plays a critical role in Pakistan’s energy sector, contributing a significant portion of the country’s total power supply. The company has been expanding its operations to include more sustainable and renewable energy sources.

– Operational Excellence and Sustainability: HUBCO’s commitment to operational excellence is evident in its efficient power generation and emphasis on reducing environmental impact. This forward-thinking approach makes it a leader in the energy sector.

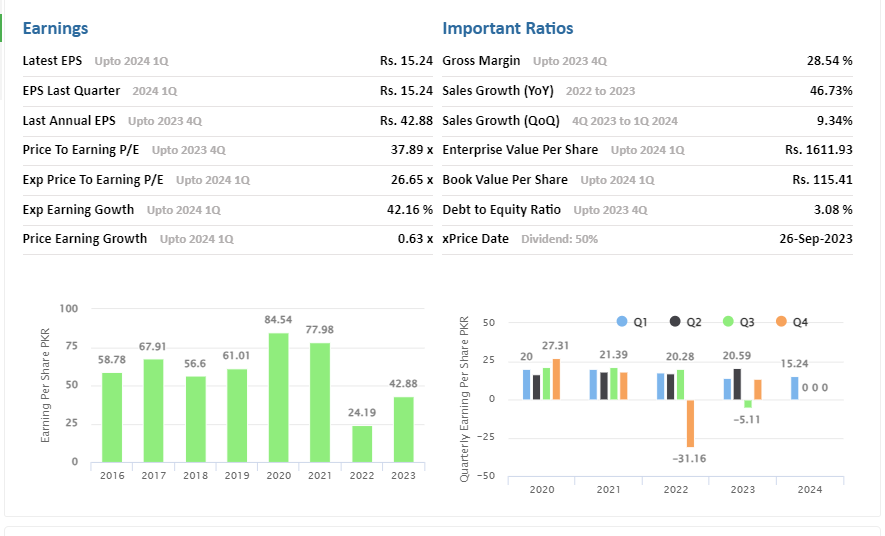

THE HUB POWER COMPANY LIMITED Stats

The Hub Power Company Limited is a leading independent power producer based in Pakistan, specializing in the development, ownership, operation, and maintenance of power stations. With an impressive installed power generation capacity of 3,581 megawatts (MW), the company plays a pivotal role in the energy sector.

For more detailed information, you can visit The Hub Power Company Limited.

4. Fauji Fertilizer Company

CEO: Sarfaraz Ahmed Rehman

Market Dominance: As the largest urea manufacturer, FFC is an integral component of Pakistan’s agricultural sector.

Financial Health: Steady growth in revenue and assets underlines its financial stability.

Investment Appeal: FFC’s market leadership and consistent sales growth make it an attractive option for long-term investment.

– Agricultural Support and Product Innovation: FFC’s range of fertilizers plays a crucial role in supporting Pakistan’s agricultural sector. The company’s focus on innovative products ensures high-quality fertilizers for various crops.

– Community Engagement and Sustainable Practices: FFC also engages in community development and sustainable agricultural practices, contributing to the overall growth of the agriculture sector in Pakistan.

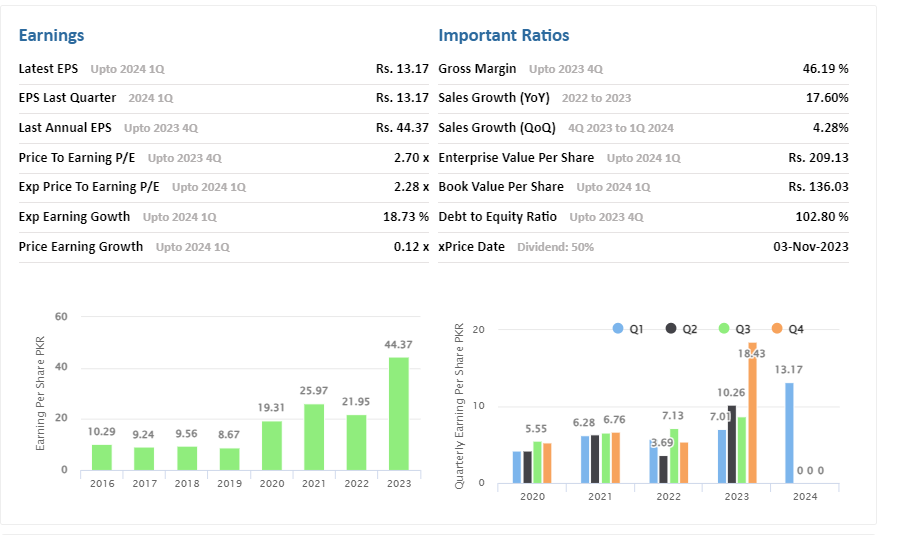

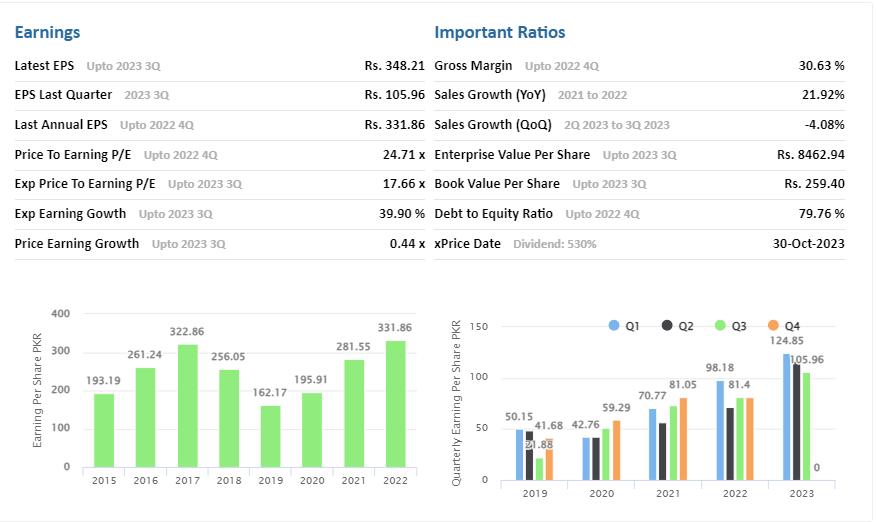

Fauji Fertilizer Company Stats

Fauji Fertilizer Company Limited, a publicly traded entity incorporated in Pakistan under the Companies Act, 1913 (now the Companies Act, 2017), is a prominent player in the fertilizer and chemical industry. The company engages in the manufacturing, purchasing, and marketing of fertilizers and chemicals, emphasizing a comprehensive approach to its operations.

For detailed insights and up-to-date information, you can visit Fauji Fertilizer Company Limited.

5. Colgate-Palmolive Pakistan

CEO: Zulfiqar Ali Lakhani

Parentage: A subsidiary of Colgate-Palmolive and the Lakson Group.

Historical Footprint: Established in 1977, it’s a household name in personal care and consumer goods.

Market Standing: Its enduring market presence and brand recognition underline its investment stability.

– Brand Strength and Consumer Trust: Colgate-Palmolive Pakistan has built a strong brand presence with a diverse range of products, earning consumer trust over the years.

– Innovation and Social Responsibility: The company’s focus on innovation and corporate social responsibility, particularly in oral health and community programs, further solidifies its position as a leader in the consumer goods sector.

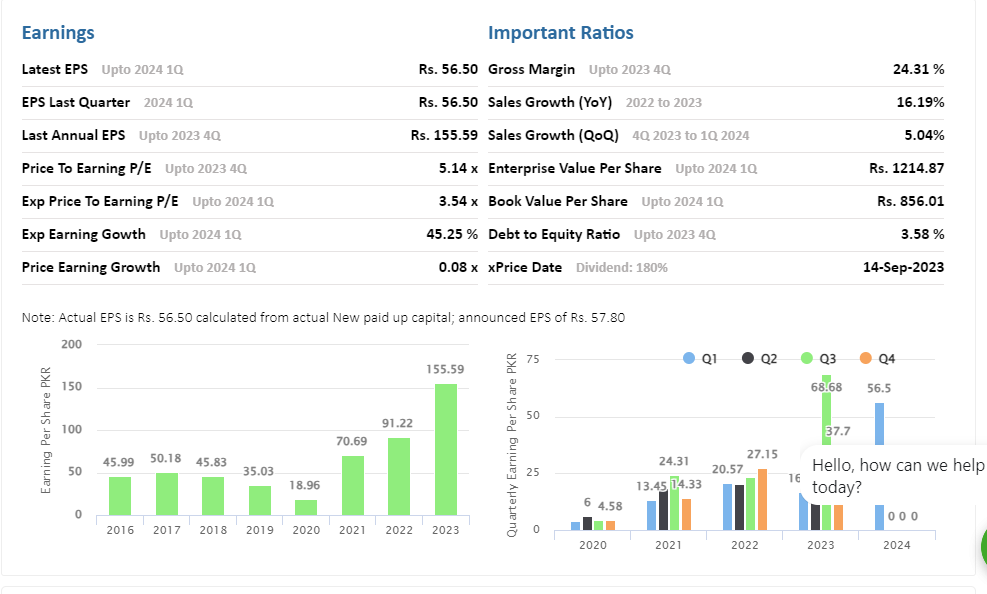

COLG - Colgate Palmolive (Pak) Ltd Stats

Colgate-Palmolive (Pakistan) Limited, established on December 5, 1977, operates as a public limited company and initially bore the name National Detergents Limited. A pivotal transformation occurred on March 28, 1990, marked by a Participation Agreement with Colgate-Palmolive Company, USA, leading to the change in the company’s name to Colgate-Palmolive (Pakistan) Limited.

For a comprehensive overview and current details, you can refer to Colgate-Palmolive (Pakistan) Limited.

6. Lucky Cement Pakistan

Leadership: Muhammad Ali Tabba

Industry Stature: Part of the Yunus Brothers Group, it stands as a major player in the construction industry.

Financial Milestone: Recording the highest-ever profit in 2023, Lucky Cement’s financial prowess is evident.

Why Choose Lucky: Its market position and impressive financial performance endorse it as a prime investment choice.

– Infrastructure Development and Export: As a leading cement producer, Lucky Cement plays a pivotal role in Pakistan’s infrastructure development. The company is also a significant exporter, contributing to the national economy.

– Environmental Initiatives and Expansion: Lucky Cement is committed to environmental sustainability and has invested in eco-friendly technologies. Their expansion into new markets and product lines continues to drive growth.

Lucky Cement Ltd. Stats

Lucky Cement Limited, established on September 18, 1993, operates as a key player in the cement industry and is incorporated in Pakistan under the Companies Ordinance, 1984 (now the Companies Act, 2017). The company’s primary focus lies in the manufacturing and marketing of cement, contributing significantly to the construction and infrastructure sectors.

For detailed insights and up-to-date information, you can visit Lucky Cement Limited.

7. Nestlé Pakistan

CEO: Samer Chedid

Diverse Portfolio: A leader in the food and beverage industry, offering a range of products from dairy to bottled water.

Growth Trajectory: A significant revenue increase in 2022 highlights its market strength.

Investment Rationale: Consistent performance and brand investment initiatives position Nestlé as a growth-oriented investment.

– Consumer Health and Quality Assurance: Nestlé Pakistan focuses on enhancing the quality of life and contributing to a healthier future. Their products are designed with consumer health in mind, ensuring high-quality standards.

– Community Engagement and Sustainability: Nestlé’s initiatives in water stewardship, sustainability, and community engagement further enhance its reputation as a responsible corporate citizen.

Nestle Pakistan Ltd. Stats

Nestlé Pakistan Limited, a public limited company, was incorporated in Pakistan under the repealed Companies Ordinance 1984 (now Companies Act 2017). As a subsidiary of Nestlé S.A, a Swiss-based public limited company, Nestlé Pakistan plays a pivotal role in the local and global food industry.

For a comprehensive overview and the latest information, you can refer to Nestlé Pakistan Limited.

8. OGDCL Pakistan

CEO: Ahmed Hayat Lak

Sector Leadership: As the largest company in oil and gas exploration, OGDCL holds a pivotal position in Pakistan’s energy sector.

Financial Robustness: Impressive sales and profit margins underline its financial health.

Investment Perspective: The company’s market capitalization and size make it an attractive option for serious investors.

– Exploration and Technological Advancements: OGDCL is at the forefront of exploring new oil and gas reserves, employing advanced technology and sustainable practices.

– Corporate Governance and Social Responsibility: The company is recognized for its strong corporate governance and commitment to social responsibility, particularly in the areas it operates.

OGDCL Oil & Gas Development Company Stats

Oil and Gas Development Company Limited (OGDCL), incorporated on October 23, 1997, operates under the regulatory framework of the Companies Ordinance, 1984 (now the Companies Act, 2017). The establishment of OGDCL was driven by the need to spearhead exploration and development activities related to oil and gas resources. This includes the crucial aspects of production, sale of oil and gas, and other associated activities, which were previously conducted by the Oil and Gas Development Corporation.

For detailed insights and the latest updates, you can visit Oil and Gas Development Company Limited (OGDCL).

9. Shell Pakistan

1. Video Insights

Management: Waqar Siddiqui

Centennial Legacy: With over 100 years in the oil and gas sector, Shell Pakistan is synonymous with resilience and innovation.

Market Resilience: Despite fluctuations, its enduring presence in the market makes it a reliable investment.

– Market Adaptation and Diversification: Shell Pakistan has adapted well to the changing market dynamics, diversifying its product range to include more sustainable energy solutions.

– Community and Environmental Focus: The company’s focus on community development and environmental sustainability initiatives sets it apart in the oil and gas sector.

Shell Pakistan Company Stats

The core activities of Shell Pakistan revolve around the marketing of petroleum products and compressed natural gas, catering to diverse energy needs. Additionally, the company plays a significant role in the lubricants market, blending and marketing various types of high-quality lubricating oils.

For a comprehensive overview and the latest updates, you can refer to Shell Pakistan Limited.

10. Honda Atlas Cars

– CEO: Takafumi Koike

– Automotive Excellence: A joint venture between Honda Motor and Atlas Group, established in 1992.

– Financial Turnaround: The recent shift to profitability indicates strong management and market adaptation.

– Investment Merits: Honda Atlas’s resilience and potential for growth make it an appealing choice for investors.

– Automotive Innovation and Customer Focus: Honda Atlas is known for its innovative automotive solutions and customer-centric approach, offering a range of vehicles that cater to diverse consumer needs.

– Sustainability and Growth: The company’s focus on sustainable practices and its potential for growth in the evolving automotive sector make it an attractive option for investors.

HCAR - Honda Atlas Cars Stats

The company’s primary activities revolve around the assembly, progressive manufacturing, and sale of Honda vehicles and spare parts. Leveraging the technological prowess and automotive excellence of its Japanese parent company, Honda Atlas Cars (Pakistan) Limited contributes significantly to the local automotive market.

For a detailed overview and the latest updates, you can refer to Honda Atlas Cars (Pakistan) Limited.

Conclusion

The Pakistani corporate sector, brimming with opportunities, presents a diverse range of investment options. From FMCG to energy, and from agriculture to automotive, these companies not only signify the economic growth of Pakistan but also offer robust investment avenues. Each company, with its unique strengths, stands as a testament to the potential embedded in Pakistan’s market. As an investor, aligning your portfolio with these giants could be a strategic step towards financial growth and stability. Happy investing in 2024!